Retain control during your lifetime and allow your loved ones to avoid probate.

What Is a Living Trust?

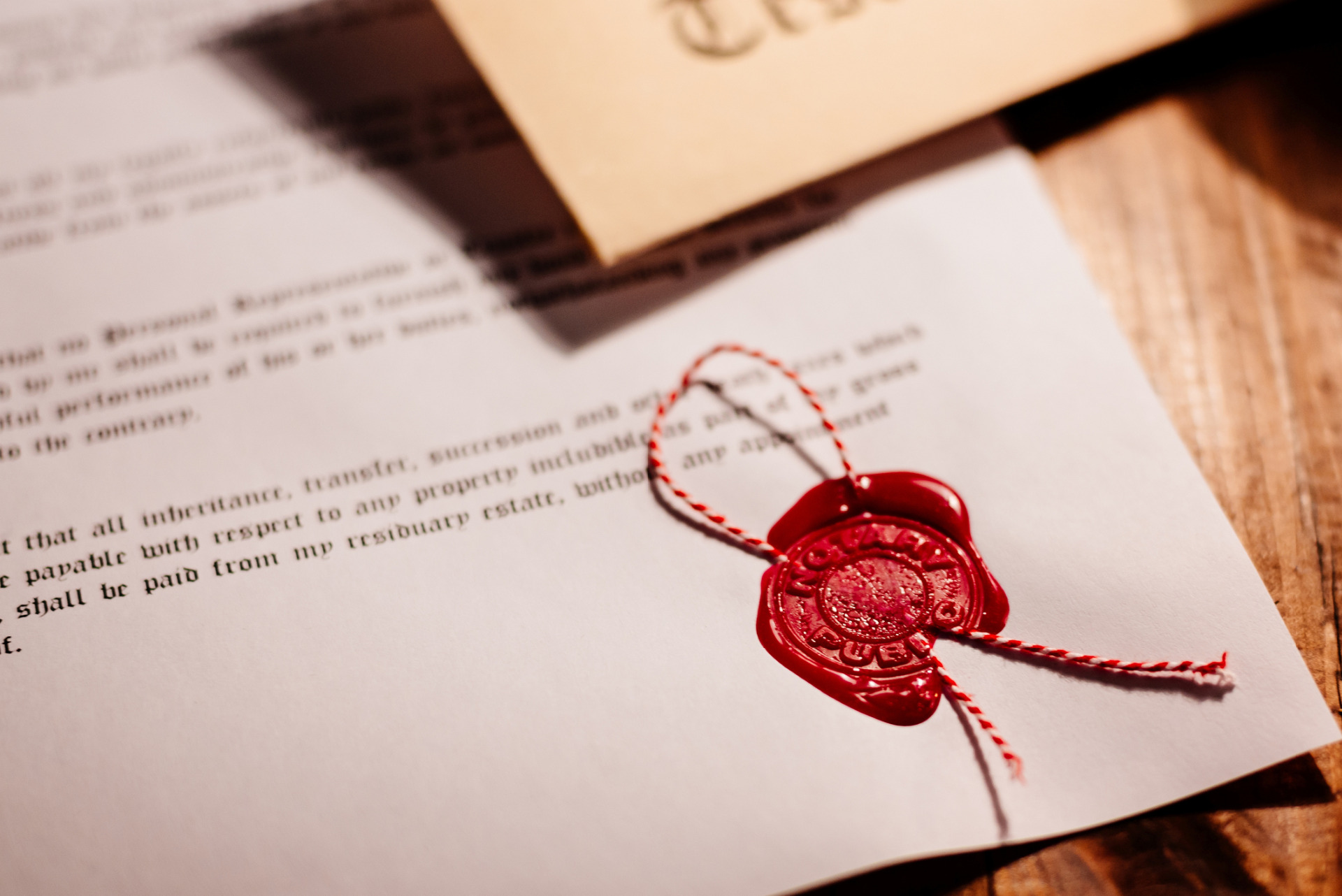

A living trust is a legal document, or trust, created during an individual’s lifetime where a designated person, the trustee, is given responsibility for managing that individual’s assets for the benefit of the eventual beneficiary. A living trust is designed to allow for the easy transfer of the trust creator or settlor’s assets while bypassing the often complex and expensive legal process of probate. Living trust agreements designate a trustee who holds legal possession of assets and property that flow into the trust.

Should I have a will or a trust?

There are several reasons to have a will or a trust. Most importantly, having a will or trust allows you to decide who will receive your property rather than leaving that choice to state law.

See FAQs for more information.

What is a revocable or living trust?

A revocable or living trust is a written document providing for the management of your property which becomes effective while you are living, unlike a will which takes effect after your death. A trust is set up for a trustee to manage your property for your benefit during your lifetime or in the event of our incapacity.

See FAQs for more information.

What if I do not have a will or a trust?

If a person dies without a will, the legislature has written a law determining how that person’s estate will be disturbed at death, called the law of descent and distribution. The law of descent and distribution will be subject to any prenuptial marriage contract.

See FAQs for more information.